Off-Plan|

Initial Sale

20

Open Community I High ROI I Flexible Payment Plan

1. Project at a Glance

2. Strategic Location & Connectivity

3. Unique Selling Propositions for Investors

4. Capital & Rental Potential

5. Developer Profile & Track Record

6. Risks & Considerations

Summary for InvestorsAzizi Milan presents a high-potential investment thanks to its scale, prime location, unique fashion-themed concept, net-zero sustainability, and flexible payment structures. The project’s developer history and global marketing efforts further reinforce its appeal.

However, investor caution is warranted: delivery delays, title deed issues, and high competition mean you should:

Actionable Next Steps

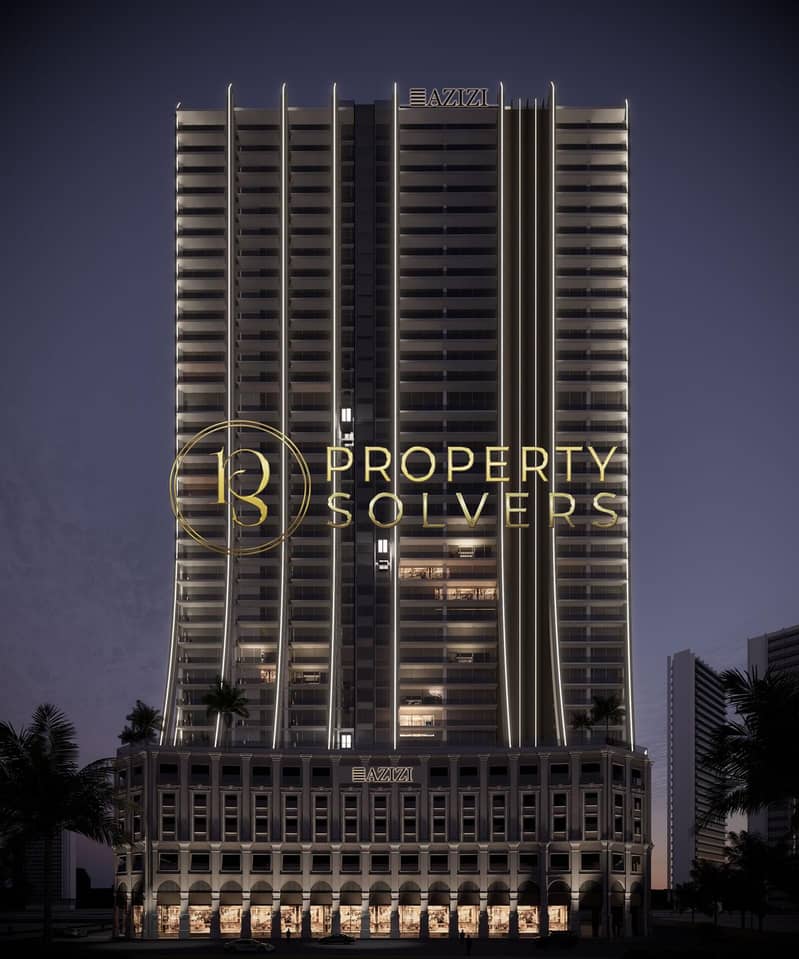

- A landmark master‑planned mixed‑use community in Dubai’s City of Arabia, covering ~40 million sq ft (over 81,200 homes)

- Total development value: AED 75+ billion, accommodating a future population of around 144,000 with 800 hotel keys

- Residential offerings: studios, 1‑, 2‑, 3‑bedroom apartments with floor‑to‑ceiling windows, balconies, and premium finishes

2. Strategic Location & Connectivity

- Sits directly on E311 (Sheikh Mohammed Bin Zayed Rd), offering seamless access across UAE – from Abu Dhabi to Ras Al Khaimah

- Within walking distance to a future Blue Line Metro Station, enhancing public transport accessibility

- Super‑close to major attractions: IMG Worlds of Adventure (1 min), Global Village (5 min), Dubai Intl Airport (~25 min)

3. Unique Selling Propositions for Investors

- Fashion‑centric urban experience: pedestrian-only fashion streets, boutique districts (perfumery, cosmetics, couture) designed as the “fashion capital of the Middle East”

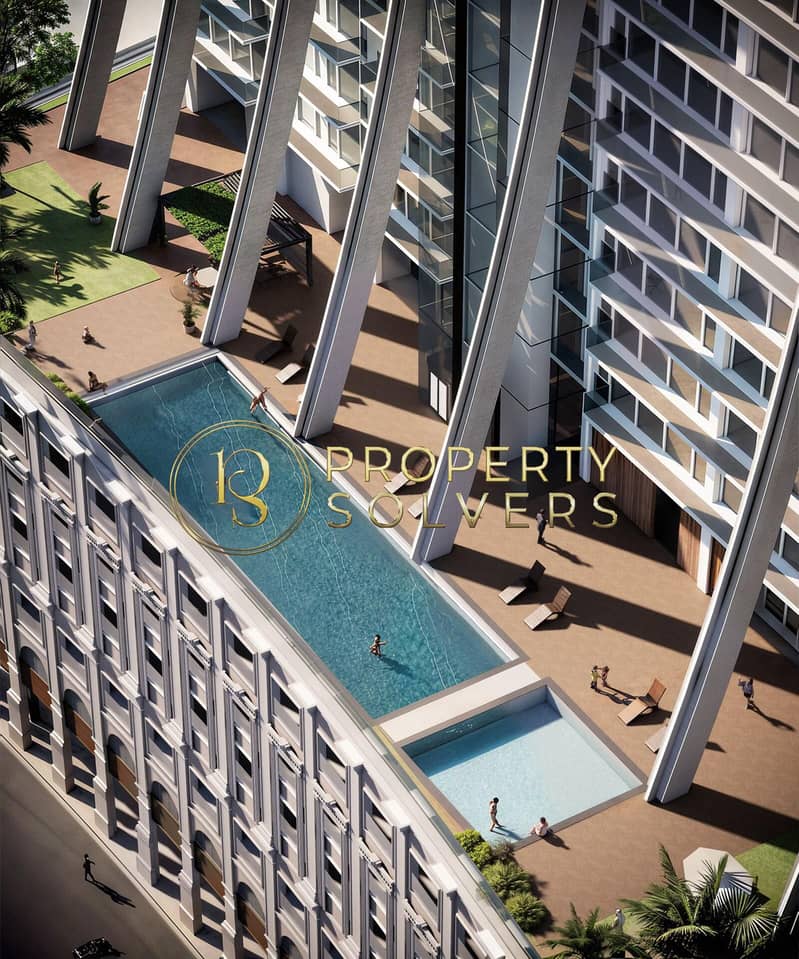

- Mixed-use resilience: retail boulevards, cinema, cafes, restaurants, mall, offices, school, clinics, mosques, parks, sports courts—diversified ecosystem for stable income

- Sustainability edge: aims for zero-carbon footprint; investments in mangrove carbon projects, forest and solar off‑sets (VERRA/Gold Standard), green roofs and rooftop gardens, EV chargers, cycling lanes

- Phased skyline expansion: tallest towers ~70 stories in the north, mid‑rise hubs transitioning into quieter zones—catering to diverse buyer/investor profiles

4. Capital & Rental Potential

- Entry pricing: studios from ~AED550–580k; 1BR ~AED950k–1.15m; 2BR ~1.6–1.7m

- Flexible payment plans: 60/40 or 80/20 options—typically 10% on booking and balanced installments through completion (~Q1 2027)

- Golden Visa eligibility: properties AED 2m+ qualify for long-term residency

- Up‑and‑coming district: City of Arabia is a rapidly developing zone; proximity to over 150 under‑development towers supports capital appreciation

5. Developer Profile & Track Record

- Azizi Developments: has delivered 40,000+ homes; some 150,000 units under construction across Dubai; known for projects like Azizi Riviera and Azizi Venice

- Strong infrastructure integration: roads, metro tie‑ins, master‑planners across city portfolios (MBR City, Dubai Healthcare City, Downtown Jebel Ali)

- Global investor roadshows: recent Dubai events showcased on May 19 & 26, 2025; targeting key cities like London, Milan, Cairo—indicates robust investor interest

6. Risks & Considerations

- Developer-delivery concerns: Azizi projects have mixed reviews—common issues include delayed qood/title issuance and customer service gaps

- Market competition: with over 150 new towers in City of Arabia, rental and capital returns could be diluted—advisable to analyze supply-demand dynamics

- Investor caution: some Reddit users advise caution (“BIG NO”) citing poor service or commitment failures; others highlight need for due diligence

- .

Summary for InvestorsAzizi Milan presents a high-potential investment thanks to its scale, prime location, unique fashion-themed concept, net-zero sustainability, and flexible payment structures. The project’s developer history and global marketing efforts further reinforce its appeal.

However, investor caution is warranted: delivery delays, title deed issues, and high competition mean you should:

- Verify Azizi’s delivery & title handover track record.

- Evaluate comparable rental yields in this exact sub-market.

- Inspect legal escrow protections & timelines in the SPA.

- Monitor enabling infrastructure (metro, roads) roll-out.

Actionable Next Steps

- Attend upcoming investor roadshows in Dubai or abroad for direct Q&A.

- Request legal transparency: SPA, escrow details, qood/title procedures.

- Benchmark rental comps and vacancy rates in City of Arabia.

- Engage a trusted Dubai real estate advisory for portfolio fit & exit strategies.

Property Information

- TypeApartment

- PurposeFor Sale

- Reference no.Bayut - 102878-KY9HZ2

- CompletionOff-Plan

- Added on1 July 2025

- Handover dateQ2 2027